GST E-Way Bill Guide

Description of GST E-Way Bill Guide

The GST E-Way Bill Guide is an application designed to assist users in managing the electronic way bill process for the movement of goods. This app simplifies compliance with GST regulations and is available for the Android platform, allowing users to download it for seamless access to its various functionalities.

The primary purpose of the GST E-Way Bill Guide is to facilitate the generation and management of e-Way Bills, which are mandatory for inter-state movement of goods valued over Rs.50,000 in motorized conveyance. Registered GST taxpayers can utilize their GSTIN for registration on the e-Way Bill Portal, while unregistered persons or transporters can enroll by providing their PAN and Aadhaar.

This application provides multiple features to enhance user experience. One of its functionalities includes a comprehensive list of items for which the GST E-Way Bill is not required, assisting users in understanding the regulations better. Users can also register directly through the app, streamlining the process of obtaining the necessary credentials for e-Way Bill generation.

In addition to registration, the app includes a transporter search option. This feature allows users to find and connect with transporters efficiently, facilitating smoother logistics operations. Another useful aspect of the app is the Tax Payer Search, enabling users to locate registered taxpayers easily. This could be particularly beneficial for those who need to verify information related to transactions.

The app also caters to transporters by providing an enrollment option, allowing them to register for the e-Way Bill system conveniently. Furthermore, it offers access to various forms required for the e-Way Bill process, ensuring users have the necessary documentation at their fingertips. This can significantly reduce the time spent searching for and completing various forms.

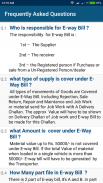

Regulatory compliance is essential when dealing with the e-Way Bill, and the app recognizes this by listing all the relevant rules associated with the e-Way Bill process. Users can refer to this section to stay updated with any changes or requirements that may impact their operations. The inclusion of FAQs helps address common queries users might have regarding the e-Way Bill, providing quick answers to frequently asked questions.

Initially launched in states like Karnataka, Rajasthan, Uttarakhand, and Kerala, the e-Way Bill system has expanded to include additional states such as Haryana, Bihar, Maharashtra, Gujarat, Sikkim, and Jharkhand. The app reflects this evolution by offering features that are relevant to users across these regions, emphasizing its utility for businesses involved in the movement of goods.

For users seeking to enhance their understanding of the e-Way Bill requirements, the GST E-Way Bill Guide serves as an informative resource. The application is designed to simplify the process of creating and managing e-Way Bills, making it easier for businesses to comply with GST regulations effectively.

The app is developed by Akshay Kotecha at AndroBuilders and operates independently as a third-party application, meaning it is not affiliated with government entities. Users are encouraged to refer to official government websites for accurate and up-to-date information regarding the e-Way Bill and GST regulations.

The GST E-Way Bill Guide stands out by providing an organized platform for users to manage their e-Way Bills efficiently. By integrating various features such as enrollment, registration, and access to necessary forms, the app ensures that users have a comprehensive toolkit for navigating the complexities of GST compliance.

This application is particularly valuable for businesses involved in logistics and transportation, as it addresses the specific needs of these sectors in relation to e-Way Bill management. The ease of access to information and resources within the app can significantly streamline operations, reducing the burden of compliance.

In light of its various features and functionalities, the GST E-Way Bill Guide is a practical tool for anyone involved in the movement of goods. Its ability to provide essential information and facilitate the registration and generation of e-Way Bills makes it an indispensable resource for businesses operating under the GST framework.

For those looking to improve their efficiency in handling e-Way Bills, exploring the benefits offered by this app may be a beneficial step towards achieving compliance and operational success.

For more information, please visit https://ewaybillgst.gov.in.